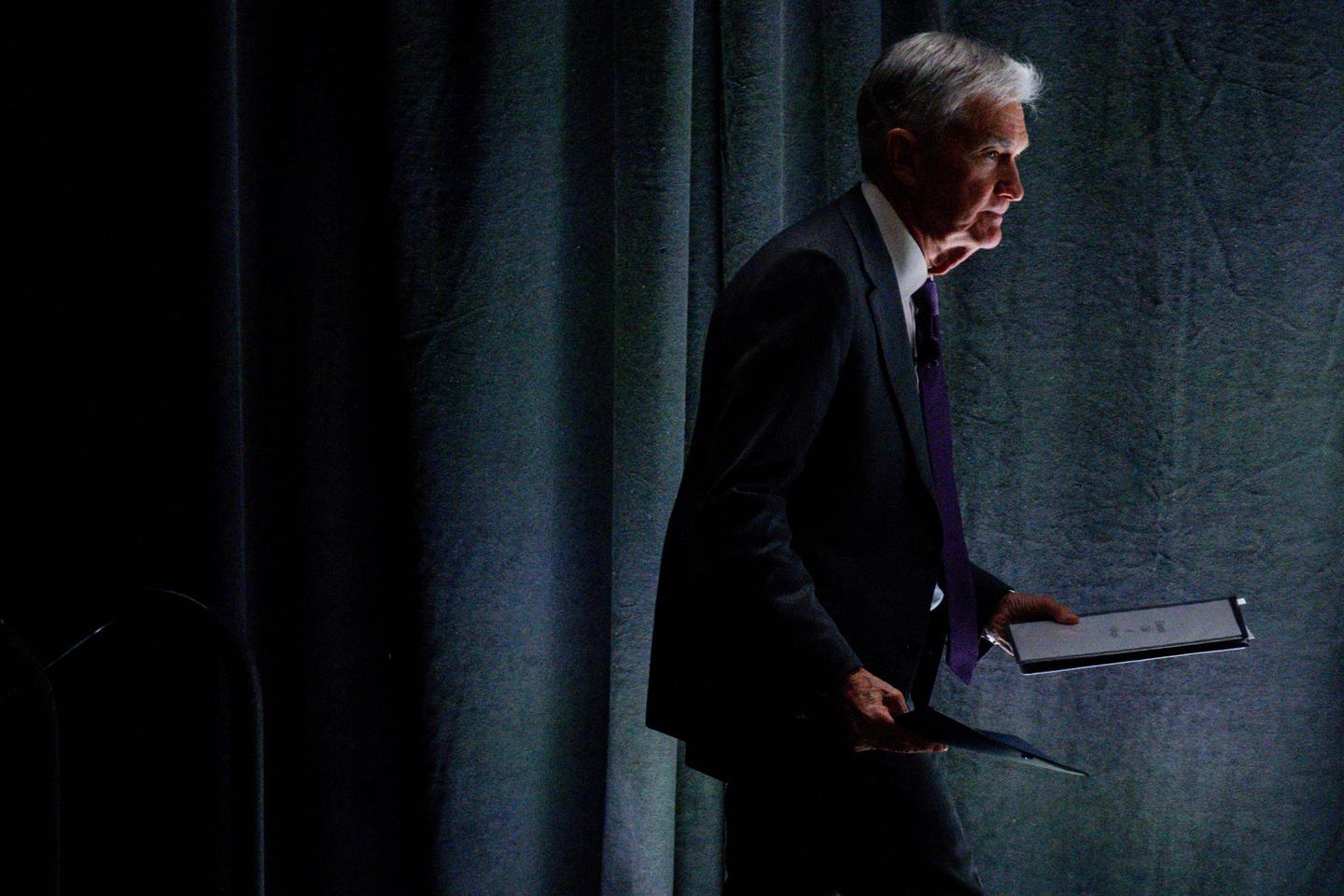

Trump Threatens to Fire Powell: Fallout and Implications

Editor’s Note: Trump's threat to fire Jerome Powell has sent shockwaves through the financial markets. This article analyzes the situation, its implications, and potential consequences.

Why This Matters: Trump's Threat to Powell and Economic Uncertainty

Donald Trump's repeated threats to fire Federal Reserve Chairman Jerome Powell are not mere political posturing; they represent a significant threat to the stability of the US economy and global markets. Powell's independence is crucial for maintaining confidence in the Fed's ability to manage inflation and interest rates without political interference. Trump's actions undermine this independence, creating uncertainty and potentially impacting investment decisions, inflation expectations, and the overall economic outlook. This article will delve into the key aspects of this ongoing situation, examining the potential consequences for the US and the world.

Key Takeaways

| Point | Impact |

|---|---|

| Threat to Fed Independence | Erodes public trust in the central bank's ability to manage the economy |

| Market Volatility | Increased uncertainty leads to fluctuations in stock prices and bonds |

| Inflationary Pressures | Potential for higher inflation due to uncertainty and potential policy shifts |

| Geopolitical Implications | Impacts global confidence in the US economy and its leadership role |

Trump Threatens to Fire Powell: A Deep Dive

The ongoing conflict between former President Trump and Federal Reserve Chairman Jerome Powell highlights a fundamental tension between political pressure and the necessity of an independent central bank. Trump's consistent criticism of Powell's monetary policy decisions, particularly his interest rate hikes, stems from a belief that these actions hindered economic growth and hurt his chances of reelection.

Key Aspects:

- Political Interference: Trump's public attacks represent a blatant attempt to influence the Fed's actions, undermining its independence and the established norms of monetary policymaking.

- Economic Consequences: The uncertainty created by these threats can lead to increased market volatility, impacting investor confidence and potentially hindering economic growth.

- Inflationary Risks: Trump's preference for lower interest rates, even amidst inflationary pressures, could exacerbate inflation if the Fed yields to political pressure.

- International Implications: The erosion of confidence in the Fed's independence has global ramifications, affecting international investment flows and the stability of the global financial system.

Powell's Role and the Fed's Mandate

Powell's role is to maintain price stability and maximize employment. Raising interest rates is a common tool to combat inflation, even if it may lead to slower economic growth in the short term. Trump's criticism overlooks the long-term benefits of controlling inflation and maintaining the credibility of the central bank.

The Risks of Political Interference in Monetary Policy

The independence of central banks is a cornerstone of a healthy economy. When political pressures override economic considerations, the result can be erratic monetary policy, leading to higher inflation, economic instability, and a loss of confidence in the currency.

Market Reactions to Trump's Threats

The stock market frequently reacts negatively to Trump's pronouncements concerning the Fed. These reactions underscore the market's sensitivity to political interference in monetary policy and the uncertainty it creates.

People Also Ask (NLP-Friendly Answers)

Q1: What is the significance of Trump's threat to fire Powell?

A: Trump's threat undermines the independence of the Federal Reserve, a crucial institution for maintaining economic stability. It creates uncertainty and can lead to market volatility and inflationary pressures.

Q2: Why is an independent Federal Reserve important?

A: An independent Fed can make decisions based on economic data, not political considerations. This fosters confidence and promotes long-term economic stability.

Q3: How could Trump's actions impact the economy?

A: Increased uncertainty can lead to market volatility, impacting investment, hindering growth, and potentially causing higher inflation.

Q4: What are the international implications?

A: Undermining the Fed's independence reduces global confidence in the US economy and its ability to manage its own affairs.

Q5: What can investors do in response to this uncertainty?

A: Diversification and a long-term investment strategy can help mitigate some of the risks associated with this uncertainty. Consult with a financial advisor for personalized guidance.

Practical Tips for Navigating Economic Uncertainty

Introduction: The current situation demands a proactive approach to managing your finances. Here are some practical steps to consider:

Tips:

- Diversify your investments: Don't put all your eggs in one basket. Spread your investments across different asset classes.

- Monitor your portfolio: Keep a close eye on your investments and adjust your strategy as needed.

- Consider hedging: Explore hedging strategies to protect yourself against potential market downturns.

- Build an emergency fund: Having a financial cushion can help you weather economic storms.

- Consult a financial advisor: Seek professional advice tailored to your specific circumstances.

- Stay informed: Keep up-to-date on economic news and trends.

- Review your debt: Assess your debt and consider strategies to manage it effectively.

- Maintain a long-term perspective: Don't panic; focus on your long-term financial goals.

Summary: These tips aim to provide a framework for navigating uncertain economic times. Remember that proactive planning can significantly reduce your vulnerability to market fluctuations.

Transition: Understanding the potential impacts of Trump's actions is crucial for effective financial planning.

Summary (Résumé)

Donald Trump's repeated threats to fire Jerome Powell represent a serious challenge to the independence of the Federal Reserve and create significant economic uncertainty. This has the potential to impact market stability, inflation, and investor confidence both domestically and internationally. Proactive financial planning is essential during this period of volatility.

Closing Message (Message de clôture)

The ongoing tension between the former President and the Federal Reserve underscores the importance of maintaining an independent central bank. The future trajectory of the US economy, and indeed the global economy, will depend significantly on how this situation unfolds. What steps do you think are necessary to mitigate the risks associated with this uncertainty?

Call to Action (Appel à l'action)

Stay informed about the latest developments by subscribing to our newsletter for regular updates on economic news and analysis. Share this article with your network to spread awareness of this critical issue.