Trump Tariff Calculation: Unraveling the Mystery

Editor’s Note: The complexities of the Trump-era tariff calculations have been a source of ongoing discussion. This article delves into the unusual methodology employed and its implications.

Why This Matters

The Trump administration's tariff calculations weren't your standard trade policy. Understanding their idiosyncrasies is crucial for several reasons: it impacts businesses' ability to plan, affects global trade dynamics, and sheds light on the potential pitfalls of unconventional tariff strategies. This article examines the methodology, highlights its peculiarities, and explores its lasting consequences on the international economic landscape. We'll analyze the impact on specific industries, the legal challenges faced, and the broader implications for future trade negotiations. Keywords: Trump tariffs, tariff calculation, trade policy, international trade, economic impact, tariff methodology, unconventional tariffs.

Key Takeaways

| Takeaway | Explanation |

|---|---|

| Non-standard methodology | The calculations deviated significantly from traditional tariff approaches. |

| Impact on specific industries | Certain sectors faced disproportionately higher costs, leading to job losses and economic disruption. |

| Legal challenges and court battles | The unconventional methods led to several legal challenges from businesses and foreign governments. |

| Long-term consequences on global trade | The methods created uncertainty and affected global trade relationships. |

| Lessons learned for future trade policy | The experience highlights the need for transparent and predictable tariff systems. |

Trump Tariff Calculation: A Deep Dive

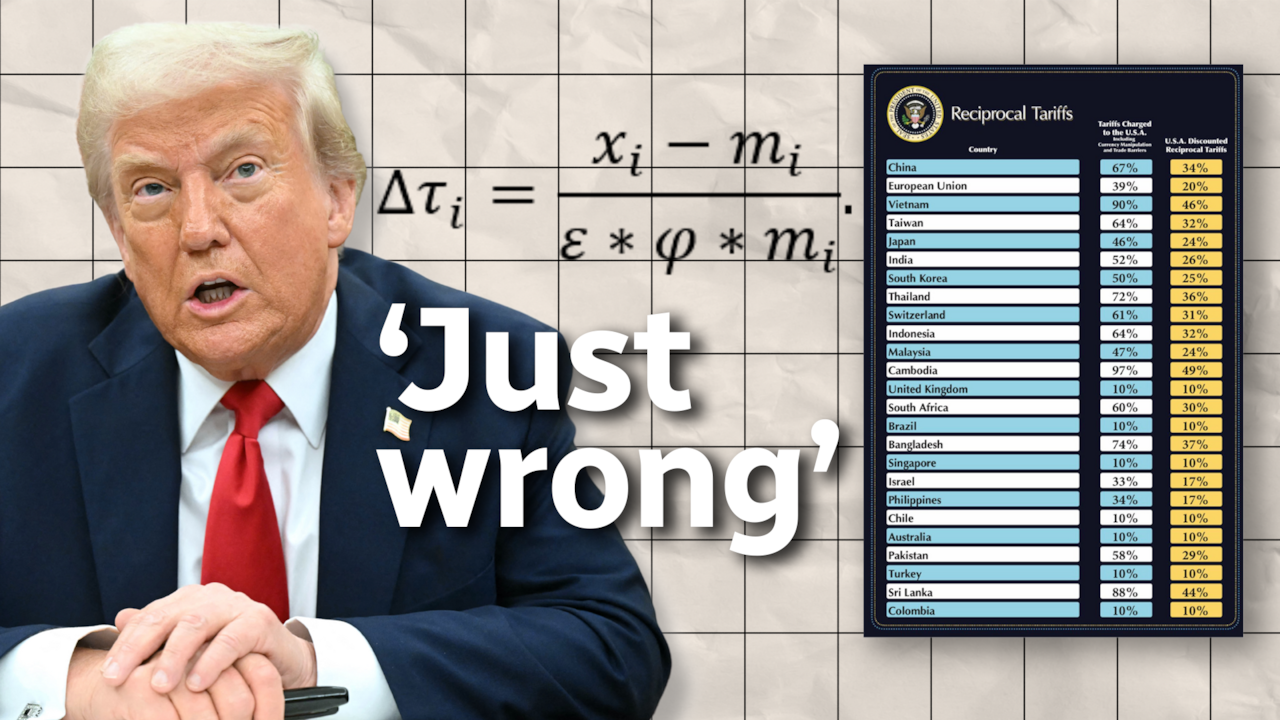

The Trump administration’s approach to tariff calculation was anything but straightforward. Unlike traditional methods that typically focus on the value of imported goods, the Trump tariffs often incorporated additional factors, leading to unpredictable and sometimes significantly higher levies than expected. This lack of transparency and the unusual calculations resulted in significant confusion and disputes.

Key Aspects of the Methodology

- Focus on Value Added: Rather than solely focusing on the final product's value, the calculations often considered the value added at each stage of production, leading to complex calculations.

- Inclusion of Non-Tariff Barriers: The calculations incorporated factors beyond simple import values, such as transportation costs and other non-tariff barriers.

- Lack of Transparency: The process lacked transparency, making it difficult for businesses to predict the ultimate cost of imports. This ambiguity hindered effective planning and investment decisions.

- Retaliatory Tariffs: The tariffs were often retaliatory, escalating trade wars and causing widespread economic uncertainty.

Detailed Analysis

One of the most controversial aspects was the use of “value-added” calculations. This approach, while arguably more nuanced, proved difficult to implement and led to considerable discrepancies and disputes. For example, a seemingly small tariff on a component could, through the value-added calculation, lead to a much larger effective tariff on the final product. This lack of predictability created significant challenges for businesses attempting to comply.

Interactive Elements

The Impact of Value-Added Calculations

The value-added approach, while aiming for greater accuracy in reflecting the contribution of different countries to the production process, resulted in significant complexity. Analyzing specific cases where this calculation dramatically increased the effective tariff reveals the practical challenges faced by businesses. This complexity led to significant delays in the application of tariffs and substantial administrative costs for businesses.

Facets: Roles of importers, exporters, and customs officials; Examples of industries disproportionately affected; Risks of miscalculation and appeals; Mitigations for businesses through legal action; Impacts on supply chains and prices.

The Legal Battles Over Trump Tariffs

Numerous legal challenges arose due to the lack of transparency and the complexity of the calculation methods. Businesses challenged the validity of the tariffs, arguing they were arbitrary, capricious, and violated international trade rules. These legal battles highlighted the significant practical and legal concerns associated with the Trump administration's unconventional approach.

Further Analysis: This section could include specific cases that reached court, the arguments made, and the outcomes. Analyzing these cases highlights the inconsistencies and the broader implications for legal challenges involving complex tariff structures.

Closing: The legal challenges underscore the importance of transparency and predictability in the application of tariffs. The inconsistent and opaque nature of the Trump tariffs has set a concerning precedent for future trade disputes.

People Also Ask (NLP-Friendly Answers)

Q1: What is the Trump tariff calculation method?

A: The Trump tariff calculation method was unconventional, often incorporating value-added at each stage of production, leading to complex and sometimes unpredictable results.

Q2: Why is the Trump tariff calculation method important?

A: It's important because it illustrates the potential consequences of opaque and complex tariff systems on businesses, trade relations, and international law.

Q3: How did the Trump tariff calculation method benefit anyone?

A: It's debatable whether this method benefited anyone. While it aimed to protect certain industries, it also created significant uncertainty and economic disruption.

Q4: What are the main challenges with the Trump tariff calculation method?

A: Main challenges include complexity, lack of transparency, legal disputes, and economic disruption.

Q5: How can businesses prepare for future tariff changes?

A: Businesses should engage in proactive monitoring of trade policy changes, diversify supply chains, and seek legal advice when necessary.

Practical Tips for Navigating Future Tariff Changes

Introduction: The unpredictable nature of the Trump tariffs underscores the need for businesses to be prepared for future tariff changes.

Tips:

- Monitor Trade Policy: Stay informed about trade developments through reliable sources.

- Diversify Supply Chains: Reduce reliance on single-source suppliers.

- Engage Legal Counsel: Seek professional advice on trade compliance.

- Utilize Trade Data: Analyze import/export data to understand potential impacts.

- Build Strong Relationships: Foster relationships with government agencies and trade organizations.

- Plan for Uncertainty: Develop contingency plans to address potential tariff changes.

- Invest in Technology: Use software to model the impact of tariffs on your business.

- Lobby for Transparency: Advocate for clear and predictable trade policies.

Summary: These tips can help businesses minimize the disruption caused by tariff changes and protect their bottom line.

Transition: Understanding the intricacies of the Trump tariff calculation is essential for navigating the complexities of international trade.

Summary (Zusammenfassung)

The Trump administration's tariff calculation method stands out for its unconventional approach and lack of transparency. This article explored its key aspects, highlighting the significant economic and legal challenges it presented. The consequences serve as a cautionary tale regarding the importance of clear, predictable, and transparent trade policies.

Closing Message (Abschlussbotschaft)

The legacy of the Trump tariffs serves as a reminder of the far-reaching consequences of complex and unpredictable trade policies. The experience highlights the need for greater transparency and predictability in international trade negotiations to foster a stable and equitable global economic environment.

Call to Action (CTA)

Stay informed about future trade developments by subscribing to our newsletter! [Link to Newsletter Signup] Share this article to help others understand the complexities of international trade. [Social Media Sharing Buttons]