Trump's Tariff Threat: European Markets Surge

Editor’s Note: Trump's renewed threat of tariffs on European goods has been met with a surprising surge in European markets. This article explores the unexpected market reaction, potential causes, and implications.

Why This Topic Matters

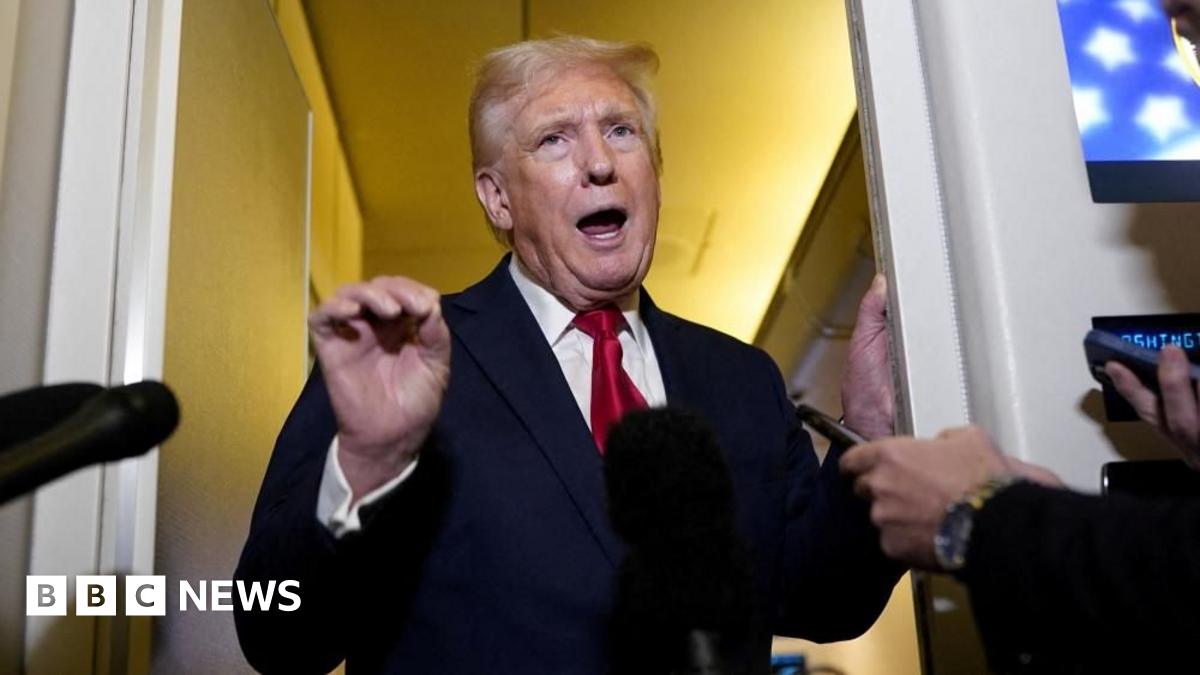

President Trump's trade policies continue to dominate global headlines, impacting markets and international relations. His recent tariff threats against Europe, while seemingly negative, have paradoxically led to a market upswing. Understanding this counterintuitive reaction is crucial for investors, policymakers, and anyone following global economic trends. This article analyzes the factors behind this surge, exploring the complexities of market behavior and the potential long-term consequences. Keywords: Trump tariffs, European markets, stock market surge, trade war, economic impact, EU economy, global trade.

Key Takeaways

| Takeaway | Description |

|---|---|

| Market Defiance of Tariff Threats | European markets surged despite Trump's tariff threats, defying initial predictions. |

| Investor Sentiment & Risk Assessment | Investors may have already priced in the risk of tariffs, or see the threat as less impactful than feared. |

| Potential for Further Volatility | The situation remains fluid, and further market fluctuations are likely. |

| Geopolitical Uncertainty Remains High | Trump's unpredictable trade policies continue to create significant global uncertainty. |

| Long-Term Economic Impacts Unclear | The ultimate long-term economic consequences of these trade tensions remain to be seen. |

Trump's Tariff Threat: A Market Paradox

Introduction: President Trump's renewed threat of imposing significant tariffs on European goods has sent shockwaves through the global economy. However, the immediate reaction in European markets was surprisingly positive, with major indices experiencing a surge. This seemingly contradictory outcome demands closer examination.

Key Aspects: The unexpected market reaction can be attributed to several interacting factors:

- Already Priced-In Risk: Many analysts believe that the threat of tariffs was already largely factored into market valuations. The market may have already anticipated this possibility, reducing the impact of the announcement itself.

- Stronger-Than-Expected European Economy: The underlying strength of the European economy may have mitigated the negative impact of the tariff threat. Positive economic indicators could have overshadowed the trade concerns.

- Investor Psychology & Speculation: Market reactions are often driven by investor sentiment and speculation. Some investors may have interpreted the tariff threat as a negotiating tactic, expecting a resolution that avoids significant trade escalation.

- Shifting Investment Strategies: Investors may be adjusting their strategies, shifting investments towards sectors less vulnerable to tariff impacts or seeking opportunities in emerging markets.

Detailed Analysis: Each of these aspects requires further exploration. For example, analyzing economic indicators like GDP growth, inflation, and unemployment rates in Europe provides a clearer picture of the region's economic health and its resilience to trade shocks. Examining investor sentiment data, such as trading volumes and volatility indices, can illuminate the psychological factors driving market behavior. Comparing the performance of different European markets and sectors can also reveal the varying degrees of vulnerability to tariff threats.

Interactive Elements

Investor Sentiment and Market Volatility

Introduction: Understanding investor sentiment is critical to interpreting the market's reaction to Trump's tariff threat. Market volatility reflects the level of uncertainty and risk aversion among investors.

Facets:

- Roles: Investors, analysts, central banks all play significant roles in shaping market sentiment and volatility.

- Examples: Increased trading volume, significant price swings, and changes in volatility indices all illustrate shifts in investor sentiment.

- Risks: High volatility can create significant losses for investors.

- Mitigations: Diversification, risk management strategies, and hedging can help mitigate some of the risks.

- Impacts: Volatility affects investment decisions, economic growth, and overall market confidence.

Summary: The analysis of investor sentiment and volatility helps explain why the market reacted positively despite the tariff threat. Understanding these facets is crucial for navigating future market uncertainties.

The Role of Geopolitical Factors

Introduction: The current geopolitical landscape significantly influences the market’s reaction to Trump’s trade policies.

Further Analysis: Beyond the immediate economic impact of tariffs, geopolitical considerations play a crucial role. The ongoing trade disputes between the US and China, along with broader geopolitical tensions, create a complex backdrop against which the European market reacted. This includes the potential for further escalation of trade wars and the resulting uncertainty for global supply chains.

Closing: Geopolitical instability often creates market uncertainty, but in this instance, investors may be anticipating a negotiated settlement or have already factored in the worst-case scenarios. This highlights the interconnectedness of global economic and political events.

People Also Ask (NLP-Friendly Answers)

Q1: What is Trump's tariff threat to Europe?

A: President Trump has threatened to impose substantial tariffs on European goods, potentially impacting various sectors and leading to a trade dispute.

Q2: Why did European markets surge despite the tariff threat?

A: Several factors contributed, including the possibility that the threat was already priced into markets, a strong European economy, investor speculation, and shifts in investment strategies.

Q3: How can the tariff threat benefit me as an investor?

A: The situation presents both risks and opportunities. Careful analysis of market trends and diversification strategies are crucial.

Q4: What are the main challenges with Trump's tariff policies?

A: Challenges include increased prices for consumers, disruptions to supply chains, potential for retaliatory tariffs, and overall uncertainty for businesses.

Q5: How to get started with investing in European markets during this uncertainty?

A: Conduct thorough research, diversify your portfolio, consult with a financial advisor, and carefully monitor market developments.

Practical Tips for Navigating Market Volatility

Introduction: The current market uncertainty requires proactive strategies for investors.

Tips:

- Diversify your portfolio: Spread your investments across different asset classes and geographical regions to mitigate risk.

- Monitor market trends: Stay informed about economic indicators and geopolitical events that could affect markets.

- Use risk management strategies: Employ techniques like stop-loss orders to limit potential losses.

- Consider hedging: Use financial instruments to protect against potential declines in specific assets.

- Consult a financial advisor: Seek professional guidance tailored to your individual investment goals and risk tolerance.

- Stay informed: Follow reputable news sources for accurate and up-to-date information.

- Don't panic sell: Emotional decisions can lead to poor investment outcomes.

- Be patient: Market fluctuations are normal, and long-term investing often yields better results.

Summary: These tips provide a framework for navigating market uncertainty, allowing investors to make more informed decisions.

Transition: Understanding the complexities of this situation is crucial for effective investment strategies.

Summary (Zusammenfassung)

President Trump’s renewed tariff threat against Europe resulted in a surprising surge in European markets. This counterintuitive reaction highlights the complex interplay of economic fundamentals, investor sentiment, and geopolitical factors. Understanding these dynamics is crucial for navigating the ongoing uncertainty in global markets.

Closing Message (Schlussbemerkung)

The market’s reaction to Trump's tariff threat underscores the unpredictable nature of global markets and the importance of staying informed and adapting strategies accordingly. What will the next unexpected market move be?

Call to Action (CTA)

Stay updated on the latest market analysis and insights by subscribing to our newsletter! Share this article with your network to spark discussion and collaboration.