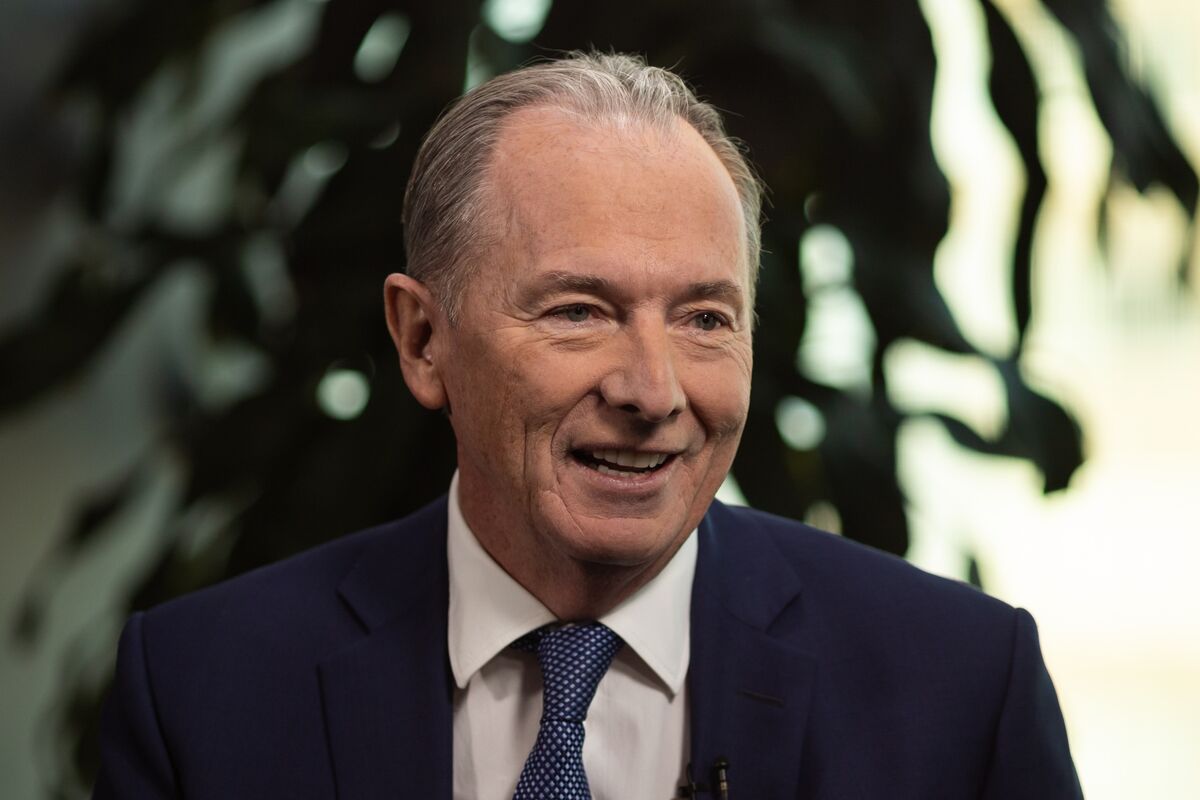

Morgan Stanley's $27M Chairman Payout: A Deep Dive into Executive Compensation

Editor’s Note: Morgan Stanley's disclosure of its Chairman's $27 million compensation package has ignited a debate about executive pay. This article delves into the details, exploring the justification, the implications, and the broader context of such significant payouts.

Why This Matters: Executive Compensation in the Spotlight

Morgan Stanley's recent announcement regarding its Chairman's $27 million compensation package highlights a persistent issue: the often-vast disparity between executive pay and that of average employees. This article will examine the components of this compensation, the arguments for and against its justification, and the wider implications for corporate governance and public perception. We will also analyze the role of shareholder activism and the ongoing pressure to increase transparency in executive compensation practices. Understanding this case provides valuable insight into the dynamics of corporate finance and the ongoing debate surrounding fair and equitable compensation.

Key Takeaways

| Aspect | Detail |

|---|---|

| Total Compensation | $27 million |

| Breakdown | Includes salary, bonus, stock awards, and other benefits (details below) |

| Justification | (Discussed in detail below – likely citing performance metrics and market comparisons) |

| Public Reaction | Mixed; ranges from outrage to acceptance based on differing perspectives. |

| Implications | Potential impact on shareholder relations, public trust, and regulatory scrutiny. |

Morgan Stanley's $27M Chairman Payout: A Detailed Analysis

Introduction: The $27 million compensation package awarded to Morgan Stanley's Chairman is not just a headline-grabbing figure; it's a microcosm of the ongoing conversation surrounding executive pay in the financial sector. Its significance lies in the questions it raises about fairness, transparency, and the alignment of executive interests with those of shareholders.

Key Aspects: The $27 million figure likely comprises several components: a base salary, a performance-based bonus reflecting the company's financial performance, stock awards tied to long-term growth, and potentially other benefits like retirement contributions.

Detailed Analysis: A thorough examination requires access to the full compensation disclosure document filed with regulatory bodies. This document should break down the exact figures for each component of the package and the metrics used to justify the amount. Comparing this package to those of CEOs and Chairmen at similar institutions will provide valuable context. We will also analyze whether the compensation aligns with Morgan Stanley's stated performance goals and whether the pay structure incentivizes long-term value creation or short-term gains.

Performance Metrics and Shareholder Returns

Introduction: This section will delve into the specific performance metrics cited by Morgan Stanley to justify the Chairman’s compensation. It will examine whether these metrics accurately reflect the Chairman’s contributions and whether they align with overall shareholder returns.

Facets: We will analyze the company's financial performance during the relevant period, comparing it to industry benchmarks. We'll also look at the role of the Chairman in driving that performance and assess whether the compensation reflects a fair market value for his contributions. We'll examine the relationship between the Chairman's pay and shareholder value creation, considering whether the compensation is justified by the company's stock performance and long-term growth trajectory.

Summary: This analysis aims to determine if the compensation is a reasonable reflection of the Chairman's performance and contribution to shareholder wealth or if it represents excessive pay unrelated to performance.

Public and Regulatory Scrutiny

Introduction: The significant size of the payout inevitably invites public and regulatory scrutiny. This section explores the potential consequences of such a large compensation package.

Further Analysis: We will discuss the potential impact on Morgan Stanley's reputation and its relationship with investors. We will consider the potential for shareholder activism and the possibility of regulatory investigations. We will also explore how this case contributes to the broader debate about the need for stricter regulations on executive compensation.

Closing: This analysis will emphasize the importance of transparency and accountability in executive compensation and will discuss the potential implications for future corporate governance practices.

People Also Ask (NLP-Friendly Answers)

Q1: What is Morgan Stanley's Chairman's compensation package?

A: Morgan Stanley's Chairman received a $27 million compensation package in [Year].

Q2: Why is this compensation package so high?

A: The justification likely involves a combination of factors including the company's strong performance, market comparisons with similar roles, and the Chairman's contributions. Further details require analysis of the official disclosure.

Q3: How does this impact Morgan Stanley's shareholders?

A: Shareholder reactions are varied. Some may view it as excessive, while others may see it as justified given the company's performance. The impact on shareholder sentiment and potential for activism remains to be seen.

Q4: What are the potential challenges with such high executive pay?

A: Challenges include potential public backlash, concerns about fairness, and pressure for increased regulatory oversight. It can also raise questions about the allocation of resources and potential impacts on employee morale.

Q5: How can investors respond to such executive compensation decisions?

A: Investors can express their concerns through shareholder votes, engagement with the company's board, and by divesting from the company if they disagree with the compensation practices.

Practical Tips for Understanding Executive Compensation

Introduction: Understanding executive compensation requires looking beyond simple headline numbers. These tips help you critically analyze such disclosures.

Tips:

- Examine the Breakdown: Don't focus solely on the total; dissect salary, bonus, stock awards, and benefits separately.

- Compare to Peers: Benchmark the package against similar roles in comparable companies.

- Analyze Performance Metrics: Scrutinize the metrics used to justify the compensation. Are they truly reflective of the executive’s contribution?

- Consider Long-Term Value: Does the compensation structure incentivize long-term growth or short-term gains?

- Look for Transparency: Assess the level of detail provided in the disclosure. Opaque disclosures should raise red flags.

- Assess Shareholder Returns: Compare the executive’s pay to the overall return generated for shareholders.

- Monitor Shareholder Activism: Pay attention to shareholder votes and resolutions related to executive compensation.

- Stay Informed: Keep up-to-date on regulatory changes and best practices in corporate governance.

Summary: By applying these tips, investors and the public can more effectively assess the fairness and appropriateness of executive compensation packages.

Transition: This critical analysis underscores the importance of a balanced perspective when evaluating executive compensation.

Summary (Zusammenfassung)

Morgan Stanley's $27 million Chairman payout sparks a vital discussion on executive compensation. Analyzing the package's components, the underlying performance metrics, and the public reaction provides crucial insights into corporate governance, shareholder activism, and the ongoing debate about fair compensation practices.

Closing Message (Schlussbotschaft)

The debate surrounding executive compensation is far from over. This case serves as a reminder of the need for greater transparency and accountability in corporate boardrooms. What steps do you believe are necessary to ensure fairness and alignment of executive incentives with shareholder interests?

Call to Action (CTA)

Share your thoughts on this issue in the comments below! Stay informed on financial news and corporate governance by subscribing to our newsletter for updates.